Every shilling counts in business. This is not news to you. Else, why would you be learning about how to hire an accountant for your business? You already know that the benefits of hiring a good accountant extend well beyond number crunching or tax codes

Senior accountants and financial officers have intimate knowledge of how finances relate to everyday operations and are often the mental sparring partner for executives, especially the CEOs. Hence, it falls on your shoulders to hire the right person for the job. So how do you find the right accountant to empower your organisation? Read on for an overview of how to discover, engage and hire a talented accountant.

Table of Contents

Step 1: Identify your finance needs

Finance and accounting is a wide field of expertise. Before you write the job ad, you will need to understand what type of accountant you are looking for and what their job will entail.

If the role is not to be involved in the day to day but more monthly-based work, then hiring an accounting firm or a part-time accountant may be the better option.

If, on the other hand, you need daily support. Then at what level? A junior accountant is more than capable of processing payroll and paying vendors, but can they handle your tax filing needs or P&L statements? To answer these questions, conduct a quick internal assessment by engaging the key stakeholders that are impacted by this hiring decision. Consider what your accounting needs are like now, and also, what they may be like in the near future. Not only will this create buy-in and clarity for the new role, but it also provides you with a list of “must haves” for the position.

Step 2: Write an effective accountant job ad

Good accountants are precise by nature, they will appreciate an ad which appeals to that approach to life. To an accountant, an attractive job ad is detailed yet succinct. How do you achieve that?

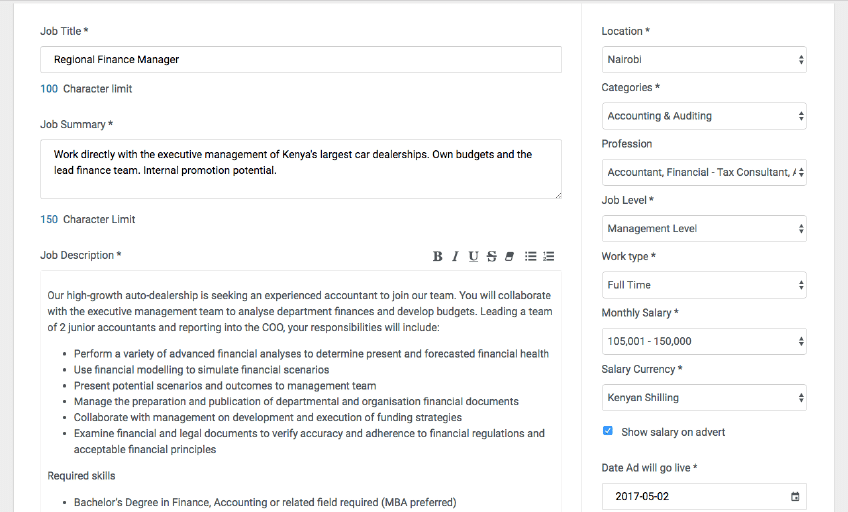

Clear job title: “Accountant” alone is not going to make the grade. A good job title includes a general term, the level of experience and any relevant special requirements. For example, “Regional Finance Manager”, “Accounts Assistant” or “Senior Auditor & Compliance Officer”

Enticing job summary: Your ad is seen by job seekers up against every other company trying to attract top finance managers. Ensure you stand out. What will make I, an accountant, want to work at your company? Be sure to connect your job summary with your employer brand.

Clear job description: Going beyond the general information about working for your business, the line manager and the existing team (if relevant), try to also be specific details on the role itself – the “must haves” list you collected earlier. For example, mention not only the role responsibilities and tasks they will be tasked with but on what time basis. Remember to feature the technical details in the description, such as what software do they require experience in. As well as academic requirements, such as what certificates are needed or years of experience required. Being concise yet specific about the position requirements makes it easier for job seekers to determine if they are qualified, or if the job is a good fit.

Below is an example of an effectively formatted job ad for your inspiration.

But a well-written job ad alone may not be enough to make it effective. Finance assistants and manager positions are among the top 5 most sought-after roles to be staffed in Kenya. So you need to ensure your job post grabs attention. Using a platform such as the BrighterMonday employer center allows you to not only reach qualified accountants but also offers options to help you stand out from the crowd. Such as branded employer pages, top of the finance & accounting category ads as well as homepage logos.

Step 3: Shortlist strong candidates

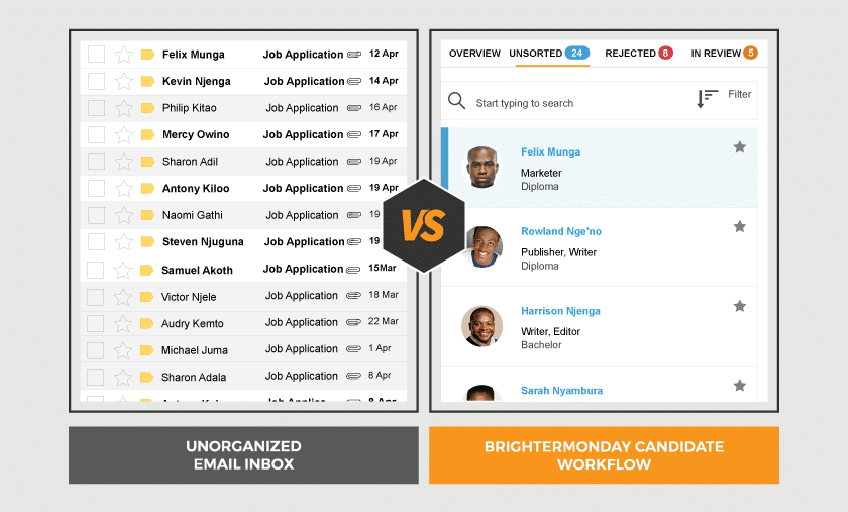

As CVs begin to roll in, you need a system to quickly and effectively classify them. Either to reject the candidate or review, shortlist, offer and hire. This can be easily managed if there are only a few applicants, but what about the more common situation where you could have a very large number of submissions?

The simplest way, utilise filters. You know your requirements. So if a candidate’s profile is not going make the grade, why spend your valuable time reading their resume? BrighterMonday offers this filtering functionality in the employer centre, so you only need to read the CVs of candidates who are qualified for your role.

Step 4: Interview potential accountants

When interviewing for any position, you should talk about what the candidate knows about the company, their relevant experience and how they would handle real-world scenarios. But how do you customise this for a finance manager position? Ask questions to shed light on the three basic areas of expertise:

- Business development: Accountants are knowledgeable of your business environment, tax situation and financial statements. This puts them in a unique position to pull all the pieces together and provide unique insights into business plans. Ask a question on what they have recommended in their past roles and how did that impact the business.

- Record keeping: Finance managers should be empowered to optimise your organisation’s recordkeeping processes in order to easily assess profitability, monitor expenses, track against a budget, alter to trends and quickly produce financial statements. Ask your candidates about what tools they have used in the past and how they have contributed to streamlining systems.

- Taxation, auditing & other technical skills: Interviewees should demonstrate their knowledge not only of tax compliance but also tax planning (how to reduce the overall tax burden) and the ability to handle different levels of audits. This will help you to understand if you hire this accountant, what can be done in-house and what must remain outsourced. If you are looking for a senior role, for these highly technical questions, it is best to have another senior accountant from your company participate in the interview or if this is not an option, have an external specialist assist in assessing competence.

However, it is not only technical skills that matter. Also, ask questions to reveal the applicant’s core values. Finance managers must work collaboratively, demonstrate strategic thinking and but most important of all, be trustworthy. How can you assess honesty? Seek out detailed information on their previous roles during the interview process and then fact check it when you call the candidate’s references.

Step 5: Hire

This may seem like the easiest part. You make your offer, the chosen candidate accepts and you begin onboarding. And it can be that simple for the top applicant. But what about all those other candidates who applied? As a hiring manager, you need to consider your employer reputation. And this means, contacting those unsuccessful candidates. Now don’t get me wrong, I am not suggesting you contact every applicant in all cases. But at least send a “thank you for applying” email to those who made it into your review processes. Not only is this common courtesy so the candidates are not left wondering, it assists your business standing. You don’t know when you will need to hire in that field again.

If you have been using your email inbox only to manage applicants, this may seem a daunting task. But if you used the BrighterMonday employer center candidate workflow, identifying and sending an email to unsuccessful applicants is quick and easy. Simply click the candidate profile, which you have previously categorised during the recruitment process, and hit ‘email applicant’ button.

What’s more, if you had applicants who may not have been suitable for this role, but could be a good company fit for future roles, you can save them into candidate pools and contact them as roles become available. Meaning you can hire without ever having to post a job ad!

Check it out for yourself by creating an employer account today.